The LiDAR Market is Fast Growing, Fragmented – and Full of Promise

Light Detection and Ranging (LiDAR), the distance measurement methodology using pulsed laser light reflection, is one of the key sensing technologies for detecting objects and determining distances in autonomous driving systems. LiDAR is one of the fastest-growing market segments today.

Autos, robotics and IoT devices use vision sensors to see their environment and support intelligent decisions such as keeping a car in its lane. One popular technology to assist in automotive vision systems is called LiDAR (Light Detection and Ranging), a laser-based approach to target an object, then measure the time for the reflected light to return. Camera sensors work fine in automotive Level 1 and Level 2 Advanced Driver Assistance System (ADAS) applications when there’s plenty of light and the weather is fine. But once there is some darkness, snow or rain, you’ll really want to add a LiDAR system to see objects more accurately so the ADAS can make decisions more safely.

The challenge is knowing which way the LIDAR market itself is traveling.

Rapid Growth in LiDAR Technology for ADAS

Yole Développement lists five market segments for LiDAR: ADAS vehicles, robotic vehicles, topography, wind and industrial. For ADAS alone, Yole has forecasted that LiDAR technology for ADAS vehicles will grow from just $19M in 2019 to a stunning $1.7B by 2025, which represents a CAGR of 114%.

Source: Yole Développement, 2020

Some LiDAR technology will be used for short-range applications that tend to be lower-cost devices, like detection of blind spots for automotive or in robotics. Long-range LiDAR is also required to detect objects such as rocks or cement barriers at a greater distance for automotive. Autonomous vehicles at Level 4 and Level 5 will require this for ensuring safety. The downside of long-range LiDAR is that it has a higher cost than short-range devices.

Multiple Topologies and Approaches Make Design Decisions Complex

When looking at all types of sensors for ADAS, research company Guidehouse Insights predicts that LiDAR will grow to somewhere in the range of 300M units by 2030. These numbers include a combination of both short-range and long-range LiDAR.

Source: Guidehouse Insights, 2020

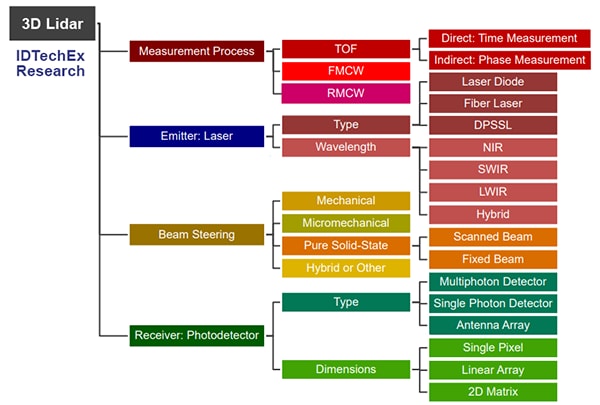

In both categories, there is no one-size-fits-all when it comes to the topologies used in LiDAR sensors because there are multiple factors to consider: measurement process, laser emitter, beam steering and photodetector receiver. A study from IDTechEx Research lays out just how many technology approaches there are when considering a LiDAR-based system:

Source: IDTechEx Research

Under beam-steering alone, designers can consider four different techniques to implement LiDAR: mechanical scanning, quasi solid-state (micromechanical), solid state with optical phased arrays (hybrid) and pure solid state with Flash technology. Each approach has pros and cons related mostly to size, cost and reliability. For example, mechanical systems exhibit a large steering angle but are larger in size, whereas solid-state options are smaller, with no moving parts. Flash-based systems are low cost and easy to integrate but are more susceptible to channel crosstalk. Balancing all these tradeoffs takes time and experience.

To make matters more complex, designers need to decide amongst different measurement methods, as shown in the IDTechEx Research diagram, with two methods coming to the forefront:

- Time of Flight (ToF) – this method uses a simpler design, is proven and has lower costs, but it suffers from weak return signal, high noise, interference and the need for high-bandwidth electronics.

- Frequency Modulated Continuous Wave (FMCW) – this method is immune to ambient noise and interference, but signal amplification, beam steering and cost control are more difficult.

Enormous Investments in Upcoming LiDAR Companies

All these various approaches to the design and implementation of LIDAR systems explain why there are so many market players in the space – which makes it all the harder to choose your supplier. According to IDTechEx Research, there are more than 100 suppliers of LiDAR technology, and over 100 R&D teams working on all of the various approaches.

Source: IDTechEx Research

The report ranks LiDAR suppliers by country in this order: USA, China, Japan, Germany, Other Europe, South Korea, Canada, UK, Israel (Source: IDTechEx Research). While innovation is widespread around the world, you can expect some consolidation among these vendors and LiDAR approaches over the coming years.

Microchip Can Contribute to Any Approach with Critical Components

No matter which LiDAR technology you pursue, Microchip can help your system design by providing multiple important components used inside of LiDAR systems.

One of the key concerns related to autonomous driving is ensuring the integrity of the data coming from the sensors. The CryptoAutomotive™ security devices from Microchip help protect the system against cyber-attacks and enable authentication of data coming from the sensors.

Field-Programmable Gate Arrays (FPGA) can be found at the heart of a LiDAR sensor. The PolarFire® FPGAs and RISC-V based PolarFire SoC FPGAs are ideally suited for this application, where low power, single event upset (SEU) immunity and small form-factor are critical requirements.

While quartz-based oscillators have been an industry standard for almost 100 years, most systems incorporate Microelectromechanical Systems (MEMS) oscillators now. MEMS devices provide higher mechanical shock ratings, are more reliable, provide higher stability over temperature and can actually be programmed in the field.

The electrical connectivity between a LiDAR sensor and automotive microcontrollers is served through Ethernet components. Microchip products are AEC-Q100 qualified and optimized for high-speed throughput, which is required for safe ADAS applications.

Distributing clean power in the harsh automotive environment is accomplished through power-management ICs, such as Microchip’s PWM controllers, switching regulators, charge pump DC-to-DC converters, CPU/system supervisors, power MOSFET drivers and Low-Dropout (LDO) regulators.

Summary

The LiDAR market is certainly one of the fastest growing product segments today, powered by the complexity of ADAS requirements. That’s why so many vendors and approaches have sprung up all over the world. Automotive design teams will have to navigate between the many approaches to come up with an optimal solution to meet size and cost metrics. As the unit volumes increase, and competition for implementations mature, then costs will continue their downward trend, enabling even more vehicles to use LiDAR.

Microchip has a comprehensive collection of supporting components used in LiDAR systems, to help deliver reliable and cost-effective ADAS products.